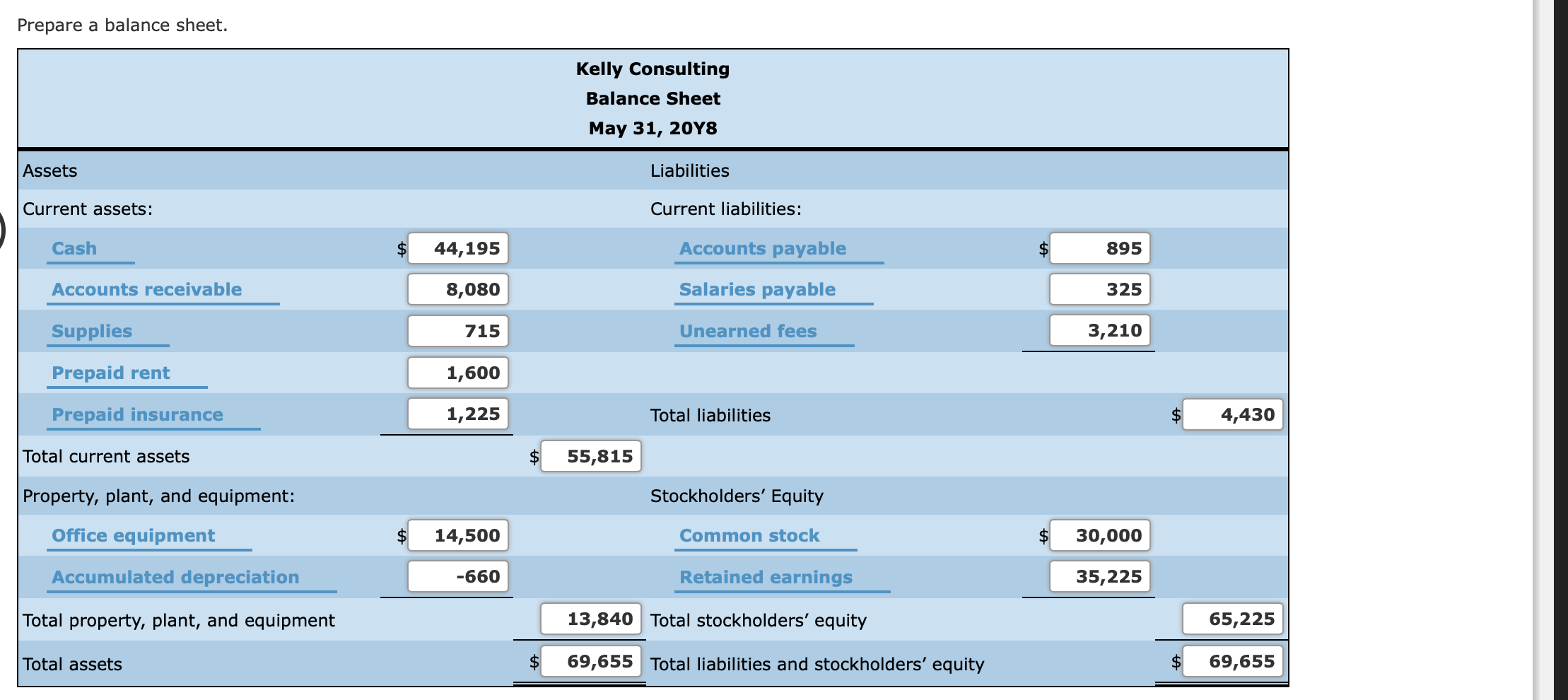

The adjusted trial balance shows a debit and credit balance of $94,150. Once the adjusted trial balance is prepared, Cliff can prepare his financial statements (step 7 in the cycle). We only prepare the income statement, statement of retained earnings, and the balance sheet. The statement of cash flows is discussed in detail in Statement of Cash Flows.

OpenStax

Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Clip’em Cliff’s ledger represented by T-accounts is presented in Figure 5.16. His consulting practice will be recognized as service revenue and will provide additional revenue while he develops his barbering practice. Cliff then prepares the balance sheet for Clip’em Cliff as shown in Figure 5.25.

4 Appendix: Complete a Comprehensive Accounting Cycle for a Business

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.

- Once all of the closing entries are journalized, Cliff will post this information to the ledger.

- Any account that has more than one transaction needs to have a final balance calculated.

- It might make sense for Cliff to not pay dividends until he increases his net income.

- Clifford Girard retired from the US Marine Corps after 20 years of active duty.

- Now that all of the adjusting entries are journalized, they must be posted to the ledger.

Reversing Entries

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in Figure depreciation of assets 5.17. The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in Figure 5.21. The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in Figure 5.22. We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here.

These purchases very much reduced your cash-on-hand, and in turn your liquidity suffered in the following months with a low working capital and current ratio. Once all of the closing entries are journalized, Cliff will post this information to the ledger. The closed accounts with their final balances, as well as Retained Earnings, are presented in Figure 5.26.

He obtains a barber’s license after the required training and is ready to open his shop on August 1. Table 5.2 shows his transactions from the first month of business. We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. The summary of adjusting journal entries for Clip’em Cliff is presented in Figure 5.19. The income statement for Clip’em Cliff is shown in Figure 5.23.

To prepare your financial statements, you want to work with your adjusted trial balance. At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods. The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings. Cliff will want to increase income in the next period to show growth for investors and lenders.

Clip’em Cliff’s post-closing trial balance is presented in Figure 5.27. The unadjusted trial balance shows a debit and credit balance of $87,900. Remember, the unadjusted trial balance is prepared before any period-end adjustments are made. You own a landscaping business that has just begun operations. You made several expensive equipment purchases in your first month to get your business started.

The full accounting cycle diagram is presented in Figure 5.14. Now that the temporary accounts are closed, they are ready for accumulation in the next period. Next, Cliff prepares the following statement of retained earnings (Figure 5.24).