Employees feed this information into a continually adjusted database that tracks each change. The automatic, or perpetual, updating of the inventory is what gives the system its name and differentiates it from the periodic approach. Your perpetual inventory system will immediately decrease the total inventory count by four units for that SKU when the widget’s barcodes are scanned. The sale of these four widgets to your customer will then trigger two accounting journal entries. With cloud technology, businesses can access inventory data from anywhere, allowing for greater flexibility and responsiveness.

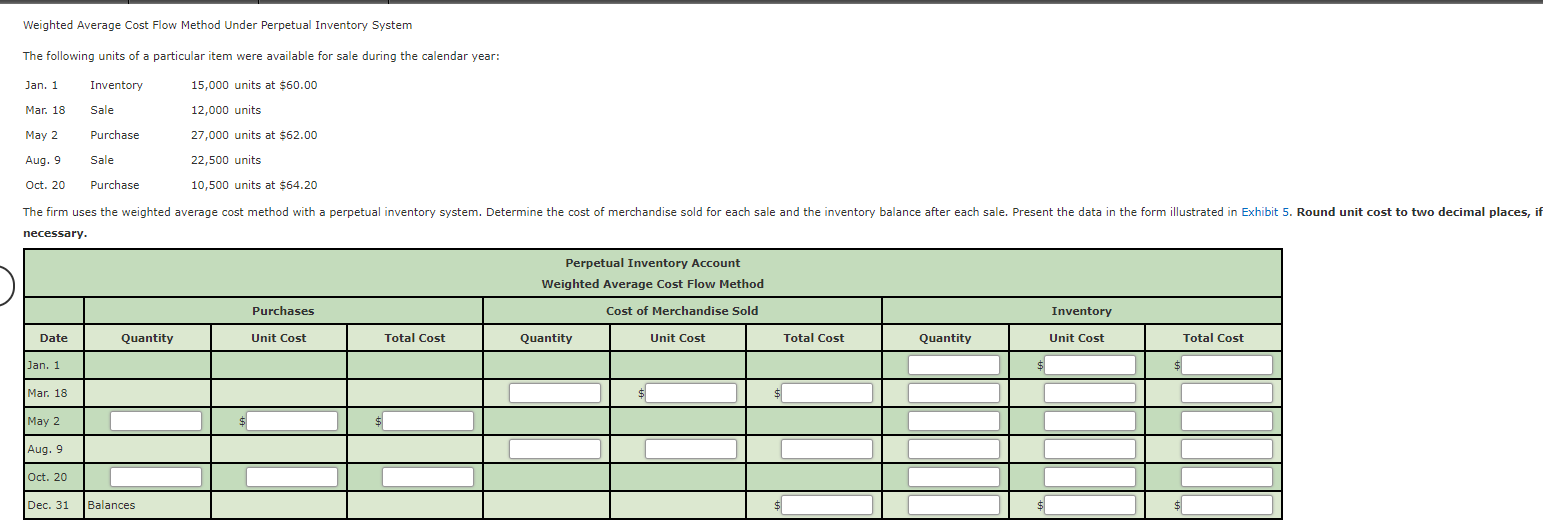

Weighted Average Cost perpetual inventory method

- This improves the overall accuracy of your inventory records, which is essential for effective decision-making.

- Technology integration in perpetual inventory systems has revolutionized inventory management.

- There are several advantages (and no real disadvantages) to using a perpetual inventory system for all kinds of businesses.

- However, advanced computer software packages have made its use easy for almost all business situations and the companies selling any kind of inventory can now benefit from the system.

- If you want to learn more about inventory accounting, and how to properly streamline your inventory management process, head over to our complete guide on inventory management.

A perpetual inventory system gives an ecommerce business an accurate view of stock levels at any time without the manual process required for a periodic inventory system. The automation that a perpetual inventory system provides frees up time and capital. As an expert fulfillment partner, ShipBob’s technology features built-in happy tax day perpetual inventory management capabilities. Through ShipBob’s dashboard, ecommerce brands can achieve real-time visibility into inventory levels and track SKUs as they are received, stowed, picked, packed, and shipped to customers. In order to be more precise when ordering inventory items, formulas can be used.

Records data accurately in real-time

It assists in eradicating labor costs and human mistakes in addition to helping in the real-time tracking of inventory data. So, employees can use the WMS to quickly scan the product whenever inventory is sent to a warehouse. The product will then automatically appear in the inventory management dashboard, available for sale on all sales channels. A perpetual inventory system uses the business’s historical data to automatically update these reorder points and keep inventory levels optimal at all times.

Purchase of Merchandise at Cost

Read on to learn more about what is perpetual inventory, how perpetual inventory systems work, and the pros and cons of perpetual inventory. Comparing the two systems, a perpetual inventory system and its counterpart, a periodic inventory system, is essential to understand their respective benefits. Both systems are methods for tracking and managing stock levels in businesses; however, they differ significantly in their approach. There are times when businesses using the perpetual inventory system may still choose to conduct a physical inventory count at the end of the year.

What’s the Difference Between a Perpetual Inventory and a Periodic Inventory System?

The advantages of the perpetual inventory system outweigh the drawbacks for most organizations with extensive stocks. If you want to learn more about the details and uses of periodic inventory, head over to our guide on the periodic inventory system. To meet client demand, you must maintain enough inventory on hand but not so much that your storage expenses are out of control. The process of accounting for perpetual inventories is shown in the following example.

Thisexample assumes that the merchandise inventory is overstated in theaccounting records and needs to be adjusted downward to reflect theactual value on hand. A perpetual inventory management system is a method of inventory tracking that updates inventory records automatically whenever a transaction occurs. This system keeps an ongoing count of stock levels, whether items are sold, restocked, or moved in or out of inventory.

Regardless of the type of inventory control process you choose, decision-makers know they need the right tools in place so they can manage their inventory effectively. NetSuite offers a suite of native tools for tracking inventory in multiple locations, determining reorder points and managing safety stock and cycle counts. Find the right balance between demand and supply across your entire organisation with the demand planning and distribution requirements planning features. When you sell products in a perpetual inventory system, the expense account increases and grows the costs of sales. Also called the cost of goods sold (COGS), the costs of sales are the direct expenses from the production of goods during a period. These costs include the labour and materials costs but leave off any distribution or sales costs.

Periodic systems involve the completion of accounting at the end of a given period. Instead, prior to the widespread use of computers, the Internet, and other digital technologies, it was common for a company to use a periodic inventory system. When deciding how to maintain control over physical inventory, it’s prudent to carefully weigh both the pros and cons of any system under consideration. Fundamental to managing inventory, maintaining the right surplus of certain products is a must. Economic Order Quantity (EOQ) considers how much it costs to store the goods alongside the actual cost of the goods.

With a periodic inventory system, COGS is calculated at the end of an inventory period. A perpetual inventory system uses point-of-sale terminals, scanners, and software to record all transactions in real-time and maintain an estimate of inventory on a continuous basis. A periodic inventory system requires counting items at various intervals, such as weekly, monthly, quarterly, or annually. The cost of goods sold (COGS) is an important accounting metric derived by adding the beginning balance of inventory to the cost of inventory purchases and subtracting the cost of the ending inventory.