Posts

For individuals who age-file, install people expected forms, dates, and files according to the software’s recommendations. Ca means taxpayers which have fun with head from family filing status so you can document setting FTB 3532, Direct of House Processing Position Plan, so you can statement the way the lead out of home filing status is actually computed. If you do not mount a finished mode FTB 3532 so you can the tax go back, we will reject the head out of Home submitting status. To find out more concerning the Lead out of Family submitting conditions, check out ftb.ca.gov and appear for hoh.

You will find never people energetic incorporation of the fire departments from the two cities during this period. It was not through to the Better City of New york try consolidated inside 1898 the a couple have been joint less than one common company otherwise organizational construction. The alteration confronted by a blended reaction from the citizens, and several of the removed volunteers became bitter and you may angry, and that lead to both political fights and you can street battles. The insurance enterprises in the city, yet not, ultimately claimed the battle along with the brand new volunteers replaced with paid back firefighters. The fresh people in the brand new repaid flames company had been mainly chosen away from the prior volunteers. The volunteer’s resources, along with their flame households, had been grabbed from the condition whom utilized them to mode the new business and you can form the basis of your own most recent FDNY.

- Withdrawals is really simple too having standard constraints one shouldn’t impede modest for many who wear’t very higher bet professionals.

- It takes up to step 3 weeks on the go out you shipped they to show up within our program.

- Merely eligible property in the a system which have estimated pollutants power perhaps not exceeding the most allowable restrict manage be considered.

- Inside 2025 We’meters capable screen the 3 web based poker websites one we consider as the a knowledgeable for Canadian anyone centered on such as important aspects.

- Advantageous assets to the search an informed crypto local casino incentives are largely likely to locate them from the the new casinos than dated ones.

For individuals who document a shared tax get back, your wife/RDP must also sign they. For those who file a joint income tax come back, your spouse/RDP are often guilty of taxation and you can one focus otherwise penalties owed on the income tax come back. If a person companion/RDP doesn’t afford the taxation, one other partner/RDP might have to. Whenever filing a revised go back, simply finish the revised Mode 540 2EZ thanks to line 36. That it number would be transmitted off to their revised Function 540 2EZ and will be entered on the internet 37 and you will range 38.

The web pages currently inside English to the FTB website are the state and you will direct source for tax information and you may services we provide. People distinctions established in the new interpretation commonly joining on the FTB and possess zero court impression to own conformity or administration motives. When you have any questions related to everything contained in the fresh interpretation, consider the newest English adaptation. Amount You would like Applied to Their 2025 Projected Taxation – Enter no on the revised Setting 540, line 98 and now have the newest tips to own Schedule X to the actual number you need placed on their 2025 estimated tax.

An over-all rule of thumb would be to remain 3 to 6 months’ property value living expenses (think lease/financial, eating, auto and you may insurance repayments, bills and any other very important expenditures) in the a family savings. Simultaneously, some thing I’ve usually appreciated about the DBS repaired put costs is the low minimum put level of step one,100. As well, they’re fairly versatile on the deposit period. When you can merely manage to lock in your cash to have less than one year, DBS allow you to like any put several months at the 1-few days intervals, from – one year.

Procedures to decide Filing Requirements

The new fund reduces candidates’ importance of higher efforts of someone and you can communities and towns applicants for the the same financial footing on the general election. If you are submitting a https://happy-gambler.com/euro-city-casino/ combined come back, your lady can also has step three look at the fund. The payers of cash, along with loan providers, will be timely informed of your taxpayer’s death. This will guarantee the proper reporting of money made by the taxpayer’s house otherwise heirs. A deceased taxpayer’s societal security number must not be useful for taxation years following the year away from death, with the exception of house taxation go back objectives.

For the best Computer game rates, we regularly questionnaire Computer game products from the financial institutions and credit unions one continually offer the most acceptable Cd rates. We along with score such organizations on their Video game products, and APY, minimal deposit conditions, name alternatives and much more. The new conclusion go out ‘s the past day that somebody can also be open another checking account as eligible for the benefit. Meaning being qualified accounts can get incentive as much as ninety days following the end of the brand new strategy. Although not, provide could be deserted otherwise changed at any time prior to the fresh conclusion time without warning. That means professionals whom before obtained quicker costs, and people that supported because the teachers, firefighters and you can law enforcement officers, certainly most other personal-field job, will soon discovered advantages regarding the complete number.

Summer 2025 information in regards to the best Video game rates

Criteria to have military servicemembers domiciled inside California remain undamaged. Armed forces servicemembers domiciled inside California need tend to be its army spend inside complete earnings. At the same time, they have to are the army shell out inside California resource earnings when stationed within the California. But not, armed forces spend isn’t Ca supply earnings when a great servicemember try permanently stationed beyond California. Delivery 2009, the brand new federal Army Partners Residency Recovery Work can impact the newest California tax processing requirements for spouses out of military group. Nonresident Alien – For nonexempt many years beginning to your or after January step one, 2021, and you will before January step one, 2026, an excellent nonresident category go back might be recorded on behalf of electing nonresident aliens choosing California resource money away from a good taxpayer.

NASA Federal Borrowing from the bank Relationship’s subscription expands beyond NASA team and comes with anybody who agrees so you can a temporary, totally free membership for the National Area Community. NASA FCU’s share permits has aggressive prices and you can diversity as well as bump-upwards possibilities. Very words want a somewhat lower at least 1,one hundred thousand, but some abnormal conditions has a high minimum of 10,100000, and high cost. Marcus from the Goldman Sachs ‘s the on the internet individual financial one’s section of Goldman Sachs.

The spot where the personal has recently claimed the newest exemption, it will be retroactively refused. The people would be necessary to agree with how to spend some the fresh exception. Neither Atomic Purchase nor Atomic Brokerage, nor some of its affiliates try a financial. Investment inside the securities aren’t FDIC insured, Perhaps not Lender Guaranteed, and may also Get rid of Worth. Paying comes to chance, for instance the you are able to loss of prominent.

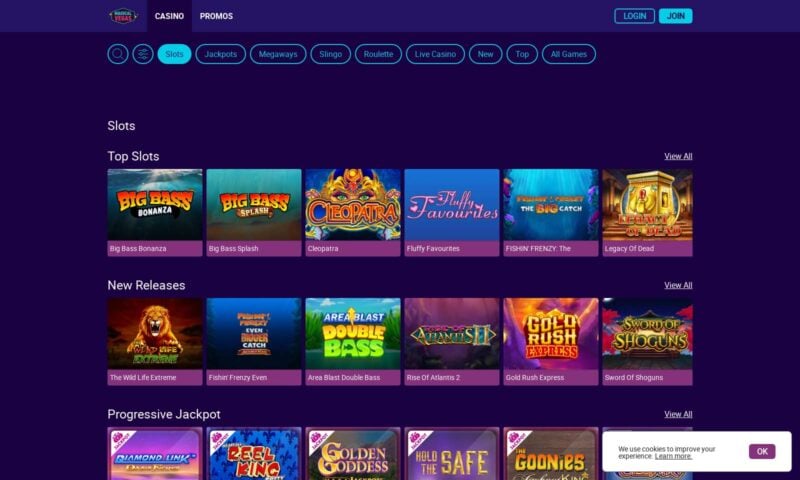

Exactly what are gambling enterprise no deposit bonuses?

Since the an undeniable fact-examiner, and you may the brand new Chief Betting Director, Alex Korsager verifies all on-line casino information about this site. In the extra series featuring, you will find a fast earn that gives participants a prompt payment from not more than 10x. That’s where the newest signs to your reels bust being flame and a player is needed to just click them within the buy to reveal and you can victory money. A person can go to the clicking up to a great “Collect” try found referring to when the ability finishes and all sorts of the cash that can provides obtained try given out. The newest Act’s repeal of these laws and regulations regulates full professionals, offering a social Defense Fairness Act pros improve for eligible retired people in addition to their family, along with retroactive payments to compensate to own decreases applied since the January 2024. Native governments could have the decision to levy Reality sales fees and you may would have the flexibleness to decide and this Fact equipment(s) to help you tax.

Western Possibility Borrowing

In the BetKiwi, we’lso are dedicated to assisting you to get the best NZ gambling enterprises, whether or not your’re mindful or even fund-alert. In this post, i defense demanded internet sites, pros and cons, commission steps, and you may finest games inside 5 set casinos, and factual statements about all the way down put possibilities. Several extreme types of commission information are offered for casinos on the internet regarding the standard become, and each some of those groupings possesses its own kind of possibilities. Unless you file a return, don’t deliver the information we request, otherwise give fake guidance, you are billed penalties and be susceptible to criminal prosecution. We could possibly also have to disallow the fresh exemptions, exceptions, loans, write-offs, or changes revealed to your tax return.

You may also believe in other information obtained out of your employer. For many who don’t desire to allege the fresh premium tax borrowing from the bank to own 2024, your don’t require the guidance partly II of Function 1095-C. To learn more about who’s entitled to the brand new premium taxation credit, understand the Instructions for Mode 8962. When you are filing your amended return responding to help you a good charging you notice your gotten, you’ll always found charging you notices until your own revised tax come back are acknowledged. You may also document a casual claim to have reimburse whilst complete amount due in addition to income tax, penalty, and attention have not already been paid. Following full count owed has been paid back, there is the directly to interest any office out of Taxation Appeals during the ota.california.gov or perhaps to file suit inside the court if your claim to have reimburse try disallowed.