He obtains a barber’s license after the required training and is ready to open his shop on August 1. Table 5.2 shows his transactions from the first month of business. We next take a look at a comprehensive example that works through the entire accounting cycle for Clip’em Cliff. Clifford Girard retired from the US Marine Corps after 20 years of active duty. The summary of adjusting journal entries for Clip’em Cliff is presented in Figure 5.19. The income statement for Clip’em Cliff is shown in Figure 5.23.

Using Liquidity Ratios to Evaluate Financial Performance

Once all journal entries have been created, the next step in the accounting cycle is to post journal information to the ledger. Cliff will go through each transaction and transfer the account information into the debit or credit side of that ledger account. Any account that has more than one transaction needs to have a final balance calculated. This happens by taking the difference between the debits and credits in an account. Cliff will only close temporary accounts, which include revenues, expenses, income summary, and dividends. To close revenues, Cliff will debit revenue accounts and credit income summary.

- You own a landscaping business that has just begun operations.

- The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

- Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries.

- The closed accounts with their final balances, as well as Retained Earnings, are presented in Figure 5.26.

- Clip’em Cliff’s post-closing trial balance is presented in Figure 5.27.

OpenStax

To prepare your financial statements, you want to work with your adjusted trial balance. At this point, Cliff has completed the accounting cycle for August. He is now ready to begin the process again for September, and future periods. The fourth closing entry closes dividends to retained earnings. To close dividends, Cliff will credit Dividends, and debit Retained Earnings. Cliff will want to increase income in the next period to show growth for investors and lenders.

4 Appendix: Complete a Comprehensive Accounting Cycle for a Business

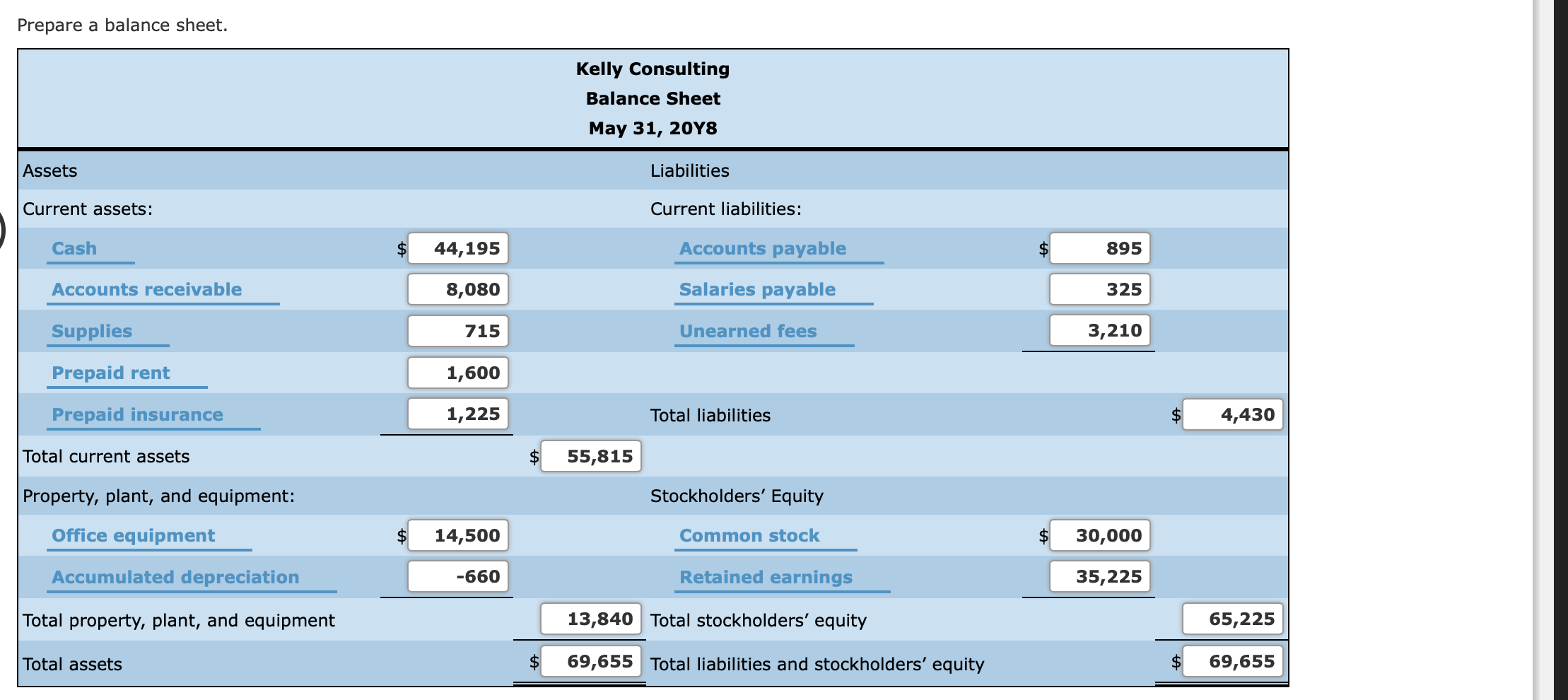

You will notice that the sum of the asset account balances in Cliff’s ledger equals the sum of the liability and equity account balances at $83,075. The final debit or credit balance in each account is transferred to the unadjusted trial balance in the corresponding debit or credit column as illustrated in Figure 5.17. The balance sheet shows total assets of $80,875, which equals total liabilities and equity. Now that the financial statements are complete, Cliff will go to the next step in the accounting cycle, preparing and posting closing entries. To do this, Cliff needs his adjusted trial balance information.

The full accounting cycle diagram is presented in Figure 5.14. Now that the temporary accounts are closed, they are ready annuity present value formula calculator for accumulation in the next period. Next, Cliff prepares the following statement of retained earnings (Figure 5.24).

Now that all of the adjusting entries are journalized, they must be posted to the ledger. Posting adjusting entries is the same process as posting the general journal entries. Each journalized account figure will transfer to the corresponding ledger account on either the debit or credit side as illustrated in Figure 5.20. It can be difficult to keep track of accruals from prior periods, as support documentation may not be readily available in current or future periods. This requires an accountant to remember when these accruals came from. By reversing these accruals, there is a reduced risk for counting revenues and expenses twice.

The support documentation received in the current or future period for an accrual will be easier to match to prior revenues and expenses with the reversal. One step in the accounting cycle that we did not cover is reversing entries. Reversing entries can be made at the beginning of a new period to certain accruals. The company will reverse adjusting entries made in the prior period to the revenue and expense accruals.

We would normally use a general ledger, but for illustrative purposes, we are using T-accounts to represent the ledgers. The T-accounts after the adjusting entries are posted are presented in Figure 5.21. The next step in the cycle is to prepare the adjusted trial balance. Clip’em Cliff’s adjusted trial balance is shown in Figure 5.22. We have gone through the entire accounting cycle for Printing Plus with the steps spread over three chapters. Let’s go through the complete accounting cycle for another company here.

You will notice that the sum of the asset account balances equals the sum of the liability and equity account balances at $80,875. The final debit or credit balance in each account is transferred to the adjusted trial balance, the same way the general ledger transferred to the unadjusted trial balance. Dividends, net income (loss), and retained earnings balances go on the statement of retained earnings. On a balance sheet you find assets, contra assets, liabilities, and stockholders’ equity accounts.